|

|

COVID-19 Alerts Volume 9 - May 15, 2020 |

Provider Relief Fund Attestation Requirements

By Kristyn Dice, V2V Management Solutions, Inc.V2V Management Solutions, Inc.

As you know the government provided financial relief to health care organizations in the form of $50 billion in grants through the CARES Act. Per HHS "$50 billion of the Provider Relief Fund is allocated for general distribution to Medicare facilities and providers impacted by COVID-19, based on eligible providers' net patient revenue. The initial $30 billion was distributed between April 10 and April 17, and the remaining $20 billion is being distributed beginning Friday, April 24." Many of our clients and colleagues have been asking for direction on how to either access these funds if they didn't get an automatic distribution or attest for it if they did. Our Payer Enrollment Team Lead, Kristyn Dice, has provided instructions on attestations within this newsletter. If you haven't yet received any of the HHS Provider Relief Funds the below link takes you to the HHS portal that allows you to provide your financial information to determine eligibility and amounts available.

CARES Provider Relief Fund Payment Portal

In addition to the Provider Relief Fund the CARES Act made available designated funds for treatment of uninsured patients with COVID. Per HHS "Providers who have conducted COVID-19 testing or provided treatment for uninsured COVID-19 individuals on or after February 4, 2020 may use this portal to request claims reimbursement." The link is below.

COVID-19 Uninsured Program Portal

For more information on the details of the relief fund distributions you can read the full report from HHS at:

https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/index.html

If you have already received a relief fund payment the information you need to attest and the steps required to conduct the attestation have been compiled below as a resource for you.

Reminder: Providers who have been allocated a payment must use this portal to sign an attestation confirming receipt of the funds and agree to the terms and conditions within 45 days of payment.

CARES Act Provider Relief Fund Payment Portal

- This portal is only for organizations who have already received payments through the CARES Act Provider Relief Fund. Before you begin this process, your organization will need to attest to each payment associated with your billing Taxpayer Identification Number(s).

- Any person authorized by the provider organization may complete this form. We would recommend that it be completed by an organization’s CFO or accounting professional.

Information You will Need

- Taxpayer Identification Number (TIN) that has received prior Provider Relief Fund payments

- TINs of subsidiary organizations that have received prior Provider Relief Funds but do not file separate tax forms (i.e., subsidiary organizations that are accounted for in the parent organization’s tax filing)

- Amount of payments received

- Relief Fund payment transaction numbers / check numbers

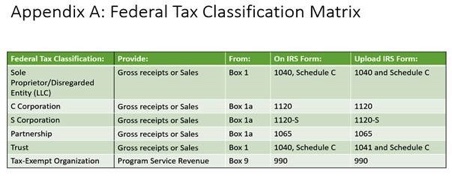

- A copy of your most recently filed tax forms - See Appendix A: Federal Tax Classification Matrix

If you have already received funds, please go to the provider portal found at:

https://covid19.linkhealth.com/#/step/1

- Complete Step one ( Eligibility) Yes or No question

- Complete Step two Enter TIN (Tax ID Number) for all TIN’s for which you received payment.

- You may enter up to 20 TINs. You may submit additional, separate requests with the same email address for additional TINs.

- Each TIN must be 9 digits with no spaces, hyphens dashes.

- Multiple TINs should be separated by commas.

- Complete Step 3 Verify Payment Information

- Enter last 6 digits of account number and EXACT relief fund payment amount for the TIN.

When the provider completes the Payment Verification and clicks continue, they will be redirected to the CARES Act Provider Relief Fund Application in DocuSign

- Complete Step Authentication

- Click Begin to be directed to next step.

- Provider will be directed to the authentication page where they will enter the access code that they received in their email as part of the above registration process. Enter the access code and click Validate.

- The provider will receive an email from CARES ACT Provider Relief Fund Application in DocuSign with the subject line: Email Validation:CARES Act Provider Relief Fund.

- The provider can click the Resume Signing button within the email confirmation page to relaunch the PowerForm Authentication Page.

- The application will open and the provider will need to select Continue in the upper right hand corner to access the document.

- Filling out the application

- Reference ID will automatically populate in top right hand corner of application

- Provider will need to complete all items in RED

- Fields with Gray boxes are optional

- Tool tips and additional instructions will appear as you hover over each field.

- TINS will automatically populate in application. This is based on the providers entry of Business TINs in the portal in a previous step. (They are un-editable).

- Primary Practice Address and Payment Address Fields are required.

- Revenue Section

- The fields in the Revenue section are dynamic and will populate based on the providers selection in Federal Tax Classification

- See Appendix A for matrix ( use this chart as a reference for completing the form)

- Example: If Sole Proprietor/Disregarded Entity (LLC) is selected, the provider will be asked to enter the appropriate data and attach the required tax form

- To attach a document, the provider should click on the yellow tag, click Upload A File, select the file from their local or shared drive, then click DONE

- Complete the Request / Provider Relief Consent

- Initial the consent by clicking the on initial field / Adopt and Initial

- Once all actions are completed, click Finish at the end of document or the top right of the page.

- After provider has finished the application a completion email will be sent to the provider.

- The completed documents can be seen by clicking the “View Completed Documents link on email.

To access the Complete User Guide on CARES Act Provider Relief Fund click the below link:

https://chameleoncloud.io/review/2977-5ea0af98f0fd0/prod

![]()

Disclaimer: V2V Management Solutions is a healthcare consulting firm. We are not licensed attorney’s or certified public accountants. This guide is not intended to replace legal or financial advice from your trusted resources. Before acting on any information provided check with the appropriate legal or financial team. This situation is a constantly evolving landscape be sure to research for most current information.The following content consists of key takeaways on information published in the above referenced articles, facts sheets, and our personal/professional experiences in financial management throughout a crisis.

V2V is here to help

Our V2V team stands by ready to assist you in navigating these turbulent times. We can quickly deploy resources to assist your team.

For Rapid Response Contact us at:

Irv Barnett, Founder: [email protected] 208-717-3941

Michelle Wier, Founder: [email protected] 208-717-3943

Debra Wiggs, Founder: [email protected] 208-717-3942